Full description not available

G**S

Très instructif

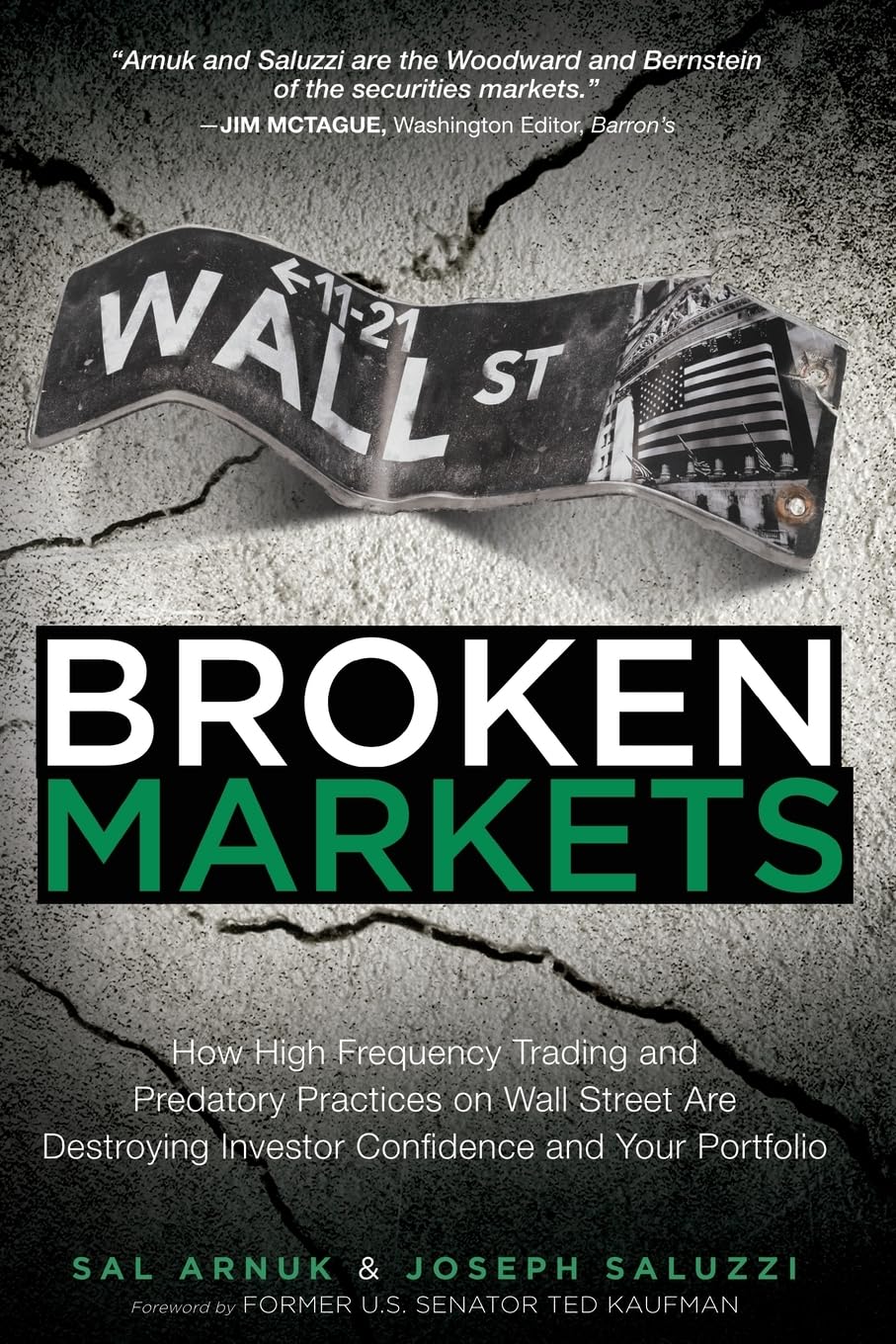

Ce livre est un bon plaidoyer en faveur de la réglementation du trading à haute fréquence, avec une documentation sérieuse. Il se rapproche de Flash Boys dans un style plus académique.

G**R

Broken Markets review

For anyone who wants to know whats wrong with the markets just read this book. As a wall street veteran with 24 yrs experince in brokerage, capital markets and asset management you will come to realize that its not you - the markets really have become a casino and "too big to fail" is the system ... and cnbc is simply it's cheerleader. It didn't happen over 30yrs ... it only took 10yrs. Further, it's not going to change, at least not anytime soon, so save your money and stop trading! This is the real time history and story of how the politicians and the banks colluded and intended ... starting in the late 90's when they tore down depression era regulations like Glass Steagal, moved to decimilization, then implemented Sarbanes-Oxley, and now Dodd-Frank ... all supposedly to save us. As a retail or professional investor, if you think you have it made now because it costs you 9.99 per trade along with your nice new slick software and inexpensive computer from which to trade - think again! Its our own real life version of "Hunger Games" against the middle class, and Washington is laughing at us all the way to the bank. Madoff and others like him couldn't have pulled it off without this new illustrious system of new multiple exchanges and new "dark pools"... They enabled him! The exchanges had over 100 years of operational history yet as the markets went mainstream in the 90's both parties set the stage for the unintended consequences that are now breaking the bank of the United States and therefore the rest of the developed and developing emerging markets. From an overzealous A. Levitt (Head of the SEC) of the Clinton Administration, through the lazy minded Head of the SEC Cox of the Bush era, and then all of it doubled down on with the "hope and change" sales job of Obama, the regulatory changes just keep on comin as each politician acts like our savior coming in to save the day with their next version of regulatory fixes. Washington and the Big-Bank lobby with European interests first helped to weaken the captial creation system of the U.S. and the the jobs machine in the 90's that made us the envy of the world all in the name of their own greed and self interest ... and all under the holistic guise of transparent and liquid markets for all. Watch your wallets when they tell you high frequency trading and computerized markets are good and provide greater liquidity and fair markets. Why do you think the (big banks) love the Federal Reserve's QE programs that are devaluing our currency and purchasing power ... like a parasite it feeds their own self interested liquidity needs and thus high frequency trading and profits machine(s), only there is a finite amount of liquidity global central banks can offer until its all over and nothing is left in its wake! Nothing in life that actually works is free. Every industry has its few bad players ... Okay, so we traded in a system that we knew worked worked for a century and replaced it with unemotional machines that now pick off human behavior and steal in the billions out another back door ... only now it's too big to fail and so we're left with the potential of an end-game. Prior to 2000 NYSE Specialists had to make markets in the stocks they represented, they were the toll takers. Now the machines just get turned off by the new and evolved "Super Soes Bandits" when they don't like the markets and thus create the "Flash Crashes" that are now part of our everyday life. How many times do you hear them tell you to use stop loss orders?! That information gets sold in seconds so then the machines pick off those orders in dark pools and leave investors with losses, just so they can take their penny spread!If all of this sounds bad its not because knowledge is power! Once you read this book and understand that our problems are all man made and self imposed by design, you'll stop trading and start investing for the long term. Stop trading and stop giving the parasite(s) the volume they need to profit and thrive! This book will incite you politically too but it is also way ahead of the curve ... and it's therapeutic ... Good Luck!

B**N

They absolutely lost me when they recommended increasing brokerage fees

These guys have a lot to say, some of it interesting.They absolutely lost me when they recommended increasing brokerage fees so Brokers could be wealthy enough to intervene in the Market to save us all from our own destruction.A lot of information in this book naive.

J**S

Five Stars

Excellent

L**3

Somewhat technical but not enlightening

When read with Scott Patterson's Dark Pools, gives a more technical side of what's going on with traders. I don't think that either author really understood much about the trading from the technical side, and the traders certainly didn't share anything with either of these authors.

Trustpilot

1 month ago

3 days ago